In today’s interconnected world, businesses can unknowingly find themselves associated with sanctioned entities – individuals, companies, or even countries deemed a threat to global security. This association can have disastrous consequences, from hefty fines to reputational damage and even legal trouble. These fines could range from a few thousand dollars to several millions and/or prison time up to 30 years.

The cost of non-compliance is high. So, how can businesses navigate this complex landscape and ensure they’re not inadvertently financing illegal activities or jeopardizing their own operations? This article will help you understand the crucial process of sanctions screening, explaining its purpose, different types of sanctions, and how to implement an efficient and effective screening program to mitigate risks associated with partnering with third parties.

What Are Sanctions?

Sanctions are international regulations that restrict trade and other interactions with certain individuals, companies, or even entire countries deemed a threat to global security, peace, or human rights. These restrictions can take various forms, categorized into the following five main types:

Economic Sanctions – These are the most common type of sanction and typically involve restrictions on trade and financial activities. This includes:

- Trade Sanctions – Limiting or prohibiting the import or export of specific goods or services. This can target specific industries or commodities, such as weapons, technology with military applications, or luxury goods. For example, sanctions might restrict a country from importing certain types of oil or exporting high-tech equipment.

- Financial Sanctions – Freezing or restricting financial assets held by sanctioned entities, including asset freezes. This can involve blocking access to bank accounts, preventing financial transactions, or prohibiting investments with sanctioned individuals or companies

Diplomatic Sanctions – These involve severing or downgrading diplomatic relations with a sanctioned country. This can include recalling ambassadors, closing embassies, or limiting communication channels between governments.

Military Sanctions – These restrict military cooperation or assistance with a sanctioned country. This could involve an arms embargo, preventing the sale or transfer of weapons or military equipment.

Sports Sanctions – These restrict the participation of individuals or teams from a sanctioned country in international sporting events.

Environmental Sanctions – These are a newer type of sanction but are becoming increasingly common. They aim to encourage countries to change their environmental policies by restricting trade in environmentally sensitive goods or technologies.

Global Sanctions Screening

Global sanctions screening involves a process of checking potential and existing third parties against these ever-evolving sanctions lists issued by international governing bodies. This ensures that enterprises are not unknowingly conducting business with sanctioned entities, which could lead to a cascade of problems, including:

- Hefty Financial Penalties – Regulatory bodies can impose significant fines for violating sanctions regulations.

- Reputational Damage – Being associated with sanctioned entities can severely tarnish your brand image.

- Supply Chain Disruptions – Sanctions violations can disrupt your carefully constructed supplier networks, causing delays and unexpected costs.

- Legal Repercussions – In severe cases, sanctions violations can even trigger legal investigations.

Now that we’ve explored the different types of sanctions and their potential consequences, let’s delve into the critical source of information used for global sanctions screening: sanctions lists.

What Are Sanctions Lists?

Sanctions lists are comprehensive databases that contain the names of sanctioned parties like states, individuals, groups, countries and legal entities. These lists act as the primary reference point for global sanctions screening.

Businesses compare their existing and potential third-parties against these lists to ensure they aren’t inadvertently associating with sanctioned entities. This helps the enterprises avoid hefty fines, reputational damage and disruptions to their supply chain.

These sanctions lists are dynamic documents, constantly evolving in response to the ever-shifting geopolitical landscape. Regularly checking your third parties against these updated lists is vital for maintaining compliance and mitigating risk.

Who Imposes Sanctions?

We’ve established the critical role of sanctions lists in global compliance. But who exactly decides who gets placed on these lists? The power to impose sanctions rests with several key authorities. There are over 75 sanctions lists issued by many authorities but here are some of the common sanctioning bodies and their lists:

The United Nations Security Council (UNSC) – Acting under Chapter VII of the UN Charter, the UNSC can impose sanctions to maintain international peace and security. These sanctions often target entire countries or specific entities within a country, restricting trade activities that could support a sanctioned regime.

The European Union (EU) – The EU can act independently or in coordination with the UNSC to impose sanctions. These sanctions often address human rights violations, terrorism financing, or the proliferation of weapons of mass destruction. EU sanctions directly impact trade compliance for member states, restricting business dealings with sanctioned entities.

The United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) – As the US enforcer of economic and trade sanctions, OFAC manages sanctions programs that can significantly impact global trade. These programs restrict US companies and individuals from engaging in certain trade activities with sanctioned entities.

Individual Countries – Many countries, beyond the US and the EU, possess the authority to impose their own sanctions regimes. These sanctions can directly affect global trade compliance by limiting trade interactions with sanctioned entities.

The landscape of global sanctions is constantly evolving, with various governing bodies imposing sanctions that impact trade activities. Staying informed about these changes is crucial for businesses to ensure they’re operating in compliance with global trade regulations

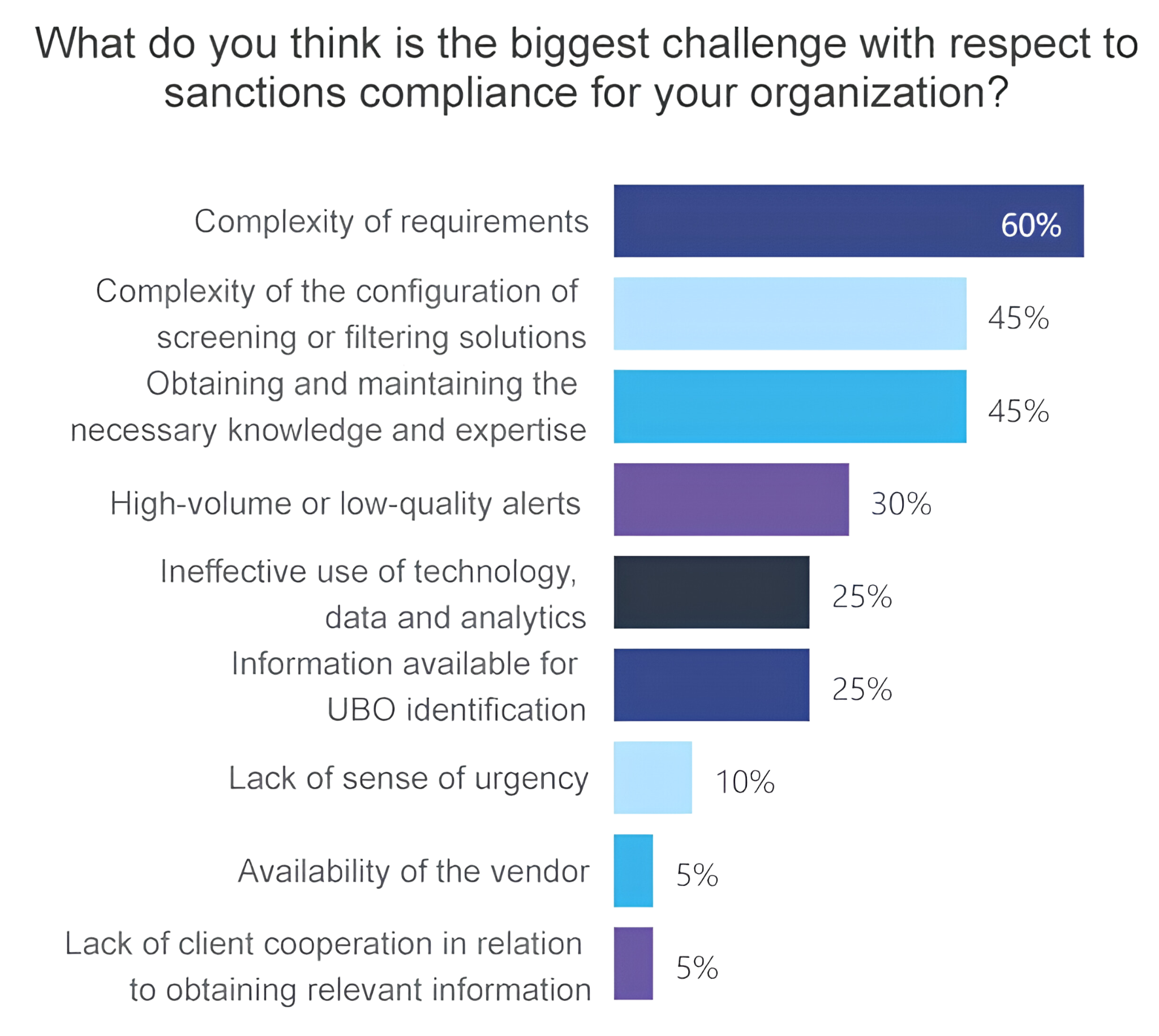

While sanctions screening is crucial for global compliance, it’s not without its challenges. Here’s a glimpse into some of the common hurdles companies face with sanctions screening:

Sanctions Screening Challenges

Complexity of Requirements – Sanctions screening regulations can be intricate and nuanced, with varying requirements depending on your industry, location, and the type of third-party relationships you maintain. Understanding and complying with these complexities can be a significant challenge.

Complexity of Configuration of Screening Tools – Sanctions screening tools can have complex configurations, requiring specialized knowledge to set up and maintain effectively. For companies without dedicated compliance personnel, navigating these intricacies can be a challenge

Alert Fatigue – Screening systems can generate a large number of alerts, many of which might turn out to be false positives. Sifting through these large volumes of alerts to identify the quality ones can be time-consuming and lead to alert fatigue, potentially causing genuine risks to be overlooked.

Keeping Up with Evolving Regulations – The global sanctions landscape is constantly shifting, with new sanctions imposed and existing ones amended or revoked. Staying informed about these changes and ensuring your screening program adapts accordingly can be a significant challenge.

Managing the Vastness of Data Sources – Sanctions screening requires checking your third-party data against a multitude of sanctions lists issued by various governing bodies around the world. Manually managing and consolidating data from these diverse sources can be incredibly time-consuming and prone to errors.

Cost Of Continuous Screening – Enterprises could have a few thousand direct vendors and tens of thousands of fourth and fifth level third-parties. Investing and maintaining a sanctions screening program for all those vendors could be very costly. This includes the expenditure on technology, training and ongoing monitoring efforts. Smaller firms with lesser budgets could struggle a lot more to balance these costs with the potential risk of non-compliance.

Of all these challenges listed above, KPMG’s research says that the complexity of requirements and solution configuration are the biggest challenges facing organizations.

The sheer volume of regulations, combined with intricate solution configurations, can make sanctions screening a resource-intensive and error-prone process. But what if there was a better way?

Effective Sanctions Screening With Enlighta

Enlighta’s Third-Party Risk Management solution empowers enterprises to overcome these complexities and achieve efficient, effective sanctions screening within their third-party management. Here’s how Enlighta tackles the common sanctions screening challenges:

Simplifying the Intricate – Enlighta cuts through the complexity of regulations. Its user-friendly platform streamlines the screening process, making it easier for you to understand and comply with evolving sanctions requirements. For example, every time a third-party is added to Enlighta platform, an automated sanctions scan is carried out. Based on the risk tier of the entity and multiple client-specific parameters, Enlighta automates continuous sanctions screening for these third-parties.

Enhanced AML Compliance – Enlighta goes beyond basic sanctions screening. Its solution incorporates Anti-Money Laundering (AML) compliance checks, providing an extra layer of protection for your business, addressing the need for enhanced AML compliance.

Effortless Configuration – With Enlighta, there’s no need to struggle with complex configuration settings. The solution is easy to set up and maintain, even for businesses without dedicated compliance expertise, addressing the challenge of complex configuration.

Continuous Monitoring – Enlighta keeps watch over sanctions lists and your third-party data, providing continuous monitoring to identify potential risks even after the initial screening process. This tackles the challenge of keeping up with evolving regulations.

Criminal Watchlist Monitoring – Enlighta can go beyond sanctions lists, offering monitoring of criminal watchlists to provide a more comprehensive risk assessment of your third parties.

PEP (Politically Exposed Persons) Sanctions Screening – Enlighta can identify Politically Exposed Persons (PEPs) and screen them against relevant sanctions lists, ensuring compliance with PEP screening requirements.

Automated Notifications to Stakeholders – Enlighta enables users and user-groups to register interest in specific entities and get alerts if there are sanctions for those entities. Also, Enlighta enables sanctions screening for fourth and fifth parties related to vendors and third-parties that an organization may be directly involved with.

Enlighta empowers businesses to minimize risk and streamline efficiency through sanctions screening. Enlighta’s comprehensive solution leverages reliable access to global sanctions lists, coupled with real-time monitoring, to proactively identify potential issues. This allows companies to swiftly address alerts using clear escalation procedures, ultimately enhancing their risk assessments and overall compliance posture.